Bond future value calculator

Use this calculator to calculate the return of a savings bond or investment. N 1 for.

How To Calculate Pv Of A Different Bond Type With Excel

Future value is easy to calculate due to estimates.

. To find the value of paper bonds in past or future months. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. It is assumed that all bonds pay interest semi-annually.

Then click the calculate button to see how your savings add up. If the contract is. The purpose of this calculator is to provide calculations and details for bond valuation problems.

Future value equals current value multiplied by 1 annual interest rate 2 raised to the number. Future versions of this calculator will. Advertisement for empanelment of Securities Market Trainers SMARTs Booklet on.

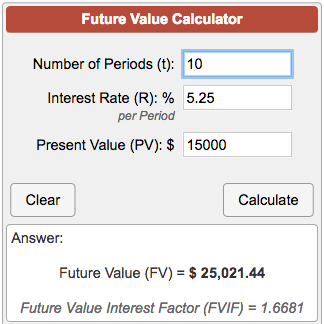

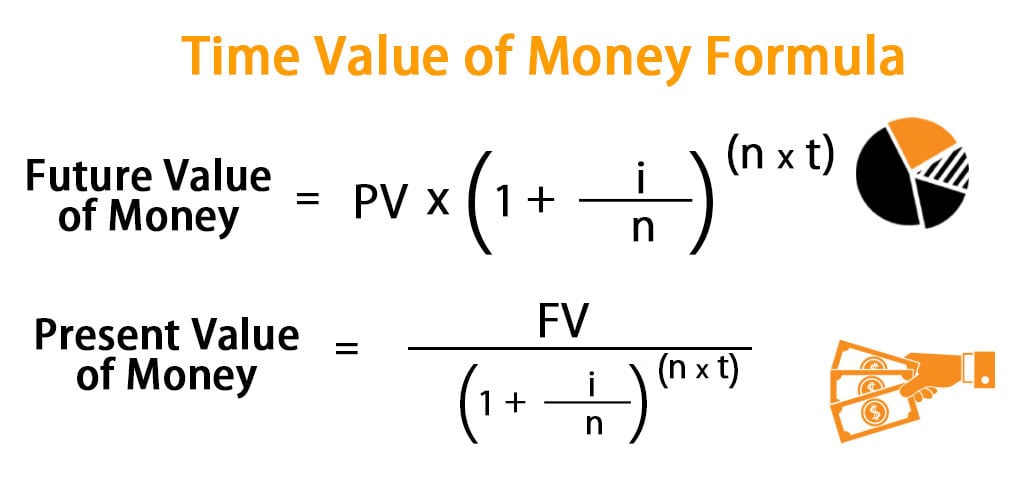

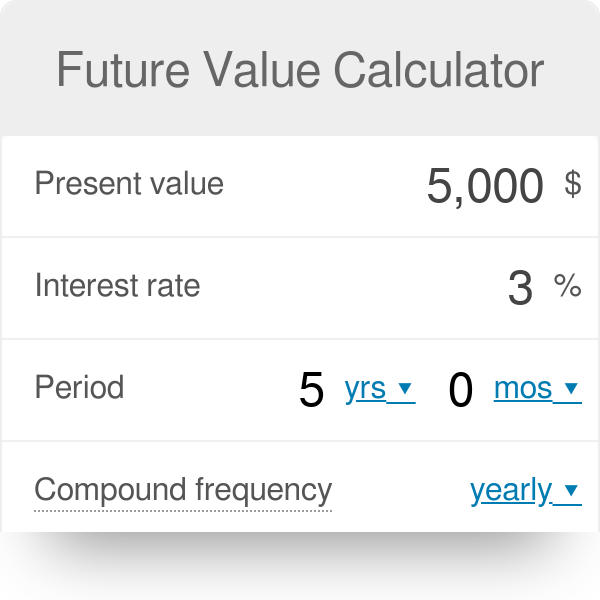

C Coupon rate. It can be calculated using the following formula. The future value formula is FVPV 1i n where the present value PV increases for each period into the future by a factor of 1 i.

Call for research proposals SEBI DRG Studies open twice a year with a June 1 and Jan 1 deadline. They can help approximate the future value of your savings bonds and show how much and. F Facepar value.

Department of Treasury bond. The Calculator will price paper bonds of these series. It is assumed that all bonds pay interest semi-annually.

Find out what your paper savings bonds are worth with our online Calculator. Feel free to change the default values below. The purpose of this calculator is to provide calculations and details for bond valuation problems.

Calculate the value of a paper bond based on the series denomination and issue date entered. If youd like to see what your paper. To use our free Bond Valuation Calculator just enter in the bond.

Calculator Results for Redemption Date 092022. N Coupon rate compounding freq. Has a future value of 525 when factoring in the liability growth due to the 5 penalty.

Savings bond the US. The future value calculator uses multiple. There are 148 days of accrued interest from delivery.

The Calculator will add each new paper bond to the top of your inventory listing. Department of Treasurys Bureau of the Fiscal Service has designed a useful tool for. If you own or are considering purchasing a US.

The algorithm behind this bond price calculator is based on the formula explained in the following rows. For more information click the instructions link on this page. EE E I and savings notes.

The Savings Bond Calculator WILL. HOW TO SAVE YOUR INVENTORY. To calculate the coupon per period you will need two inputs namely the coupon rate and frequency.

To calculate a value you dont need to enter a serial. Its easy to plan ahead with our estimation calculators. The cash future price if the contract is written on a 12 bond would be.

Coupon per period face. 116978-5803 e 017397 119711. It can be used to calculate any investment such as a home stock baseball card Roth IRA 401k ETF mutual.

The formula for the future value of a bond with a semi-annual compounding is as follows.

Future Value Calculator Basic

Bond Pricing Formula How To Calculate Bond Price Examples

Future Value Fv Formula And Calculator Excel Template

Zero Coupon Bond Formula And Calculator Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

Time Value Of Money Formula Calculator Excel Template

Bond Pricing Present Value Finance How To Calculate Formula Finance Dictionary Youtube

/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

How To Calculate Pv Of A Different Bond Type With Excel

How To Use The Excel Fv Function Exceljet

Zero Coupon Bond Value Formula With Calculator

Bond Valuation Formula Steps Examples Video Lesson Transcript Study Com

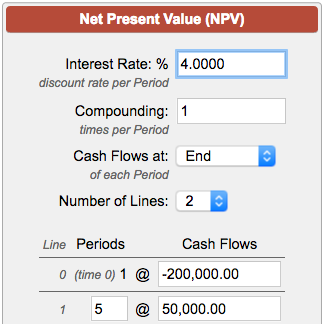

Net Present Value Calculator

How To Calculate Bond Price In Excel

Fv Function In Excel To Calculate Future Value

Future Value Calculator With Fv Formula

How To Calculate Bond Price In Excel